What you’ll learn:

- Without insurance, the list price of Mounjaro® is about $1,112 per month.

- Insurance may cover Mounjaro® when prescribed for type 2 diabetes, but weight-loss coverage is rare.

- When used for weight loss, Zepbound might be the more affordable alternative to Mounjaro when paying out of pocket.

In recent years, Mounjaro® has become a name people recognize, on par with Ozempic®. Like Ozempic®, it’s a once-weekly injectable approved to manage type 2 diabetes that is now frequently also used for off-label weight management. As more people ask about how it works and who it’s for, they are also looking into how much it costs.

And for many people, the over $1,000 per month price tag can be a large hurdle. But if you’re considering a prescription for Mounjaro® for weight loss, there are ways to save and alternatives that might make more sense.

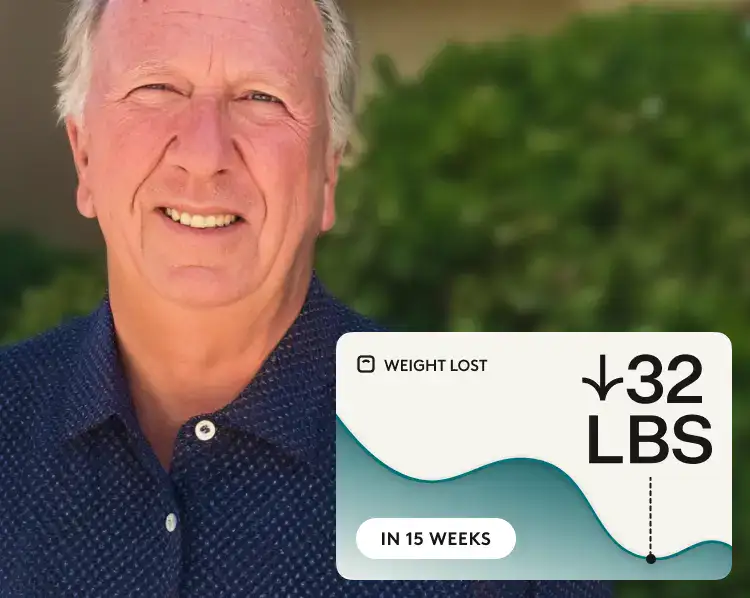

Rx weight loss, the right way, with Noom

Get access to prescription weight loss medication with Noom.First, it’s important to know that insurance approves Mounjaro only if prescribed for diabetes management. Weight loss isn’t commonly an insurance-supported use, so if your doctor prescribes it for that purpose, you’ll likely pay out of pocket. While there are some ways to save, like pharmacy discounts and shopping around, there isn’t likely to be a big discount.

Mounjaro®’s sister medication, Zepbound®, is another option if weight loss is your primary goal. While it’s also unlikely to be covered by insurance, it contains the same active ingredient (tirzepatide) at the same doses and is often associated with lower out-of-pocket costs in some forms. Because it’s the same medication, effectiveness is comparable—clinical trials show average weight loss of about 21% of body weight over roughly two years of treatment.

Let’s take a closer look at what Mounjaro® costs without insurance in 2026, and what options may help lower that monthly price. We’ll also discuss whether some forms of Zepbound® might be a better fit in terms of cost.

Price snapshot (estimated monthly costs)

| Cost scenario | Estimated monthly price |

|---|---|

| List price (MSRP) | $1,112 monthly |

| With insurance | $25–$150 (varies by plan) |

| Without insurance (cash) | $995* |

| Cheapest alternative | If you’re interested in using tirzepatide for weight loss purposes, Zepbound® vials will likely cost less out of pocket. |

*Estimated pricing varies based on eligibility, dose, and available discounts.

News: Mounjaro® cost updates in 2026

Because Mounjaro® pricing can change, staying up to date on the latest news can make a real difference in what you pay. Policy shifts and new manufacturer programs don’t happen often, but when they do, they can create meaningful savings. Here are recent updates worth knowing about:

- November 6, 2025 – A White House pricing agreement outlined lower Medicare and Medicaid pricing for several GLP-1 medications, including Mounjaro®, with benchmark prices set around $245 per month. These changes aren’t immediate and are expected to roll out in 2026, as Medicare and state Medicaid programs update coverage and pricing rules. Coverage for Mounjaro® continues to depend on diagnosis and individual plan rules, meaning the reduced price generally applies when it’s prescribed for diabetes.

Get a more detailed background on current Mounjaro® pricing and savings strategies: Mounjaro® costs with and without insurance coverage.

How much does Mounjaro® cost per month without insurance?

Eli Lilly has set the list price for Mounjaro® at about $1,112 per month. Think of this as the sticker price before insurance or any discounts are applied. Most people don’t pay this full amount because coupons, pharmacy programs, or insurance benefits can lower the cost.

Other costs of taking Mounjaro®: Doctor’s visits, lab work, and follow-ups

Your Mounjaro® budget needs to include more than the price of the physical medication. It is common for prescriptions to require an initial visit and regular follow-ups with a provider, plus occasional lab work, as needed. These costs can add up over time, especially if they are not bundled into a care program or covered separately.

To make pricing easier to understand, here is a breakdown of the most common ways people pay for Mounjaro® and who each option tends to work best for.

| Payment scenario | Estimated monthly cost | Who is this for? |

|---|---|---|

| Full retail price | $1,112 | People paying entirely out of pocket |

| With insurance | $25–$150 (varies by plan) | People with insurance plans covering Mounjaro® for diabetes |

| With a savings card | As low as $25 per month | People with private insurance, even if the medication isn’t fully covered |

| With pharmacy discounts | $995* | No insurance, self-pay |

*Estimated pricing varies based on eligibility, dose, and available discounts.

Learn more: Mounjaro® costs with and without insurance coverage

Do you need a prescription for Mounjaro®?

Yes. Mounjaro® is a prescription-only medication and isn’t available over the counter. There is no legal way to buy Mounjaro® without a prescription in the U.S.

Getting a prescription doesn’t necessarily mean scheduling a costly specialist visit. You can get a Mounjaro® prescription through a telehealth service, like Noom Med, where a licensed clinician reviews your medical history and determines if the medication is appropriate. This approach is often one of the more affordable ways to access a legitimate prescription.

How to get a prescription for Mounjaro: Telehealth vs. in-person

How you get a Mounjaro® prescription can make a big difference in what you spend, especially without insurance. In many cases, the cost of care around the prescription ends up being just as important as the cost of the medication itself.

- Traditional in-person care often comes with higher expenses. An initial visit with a specialist can easily cost $200 or more, with follow-up appointments adding another $150 or so each time. Lab work is usually billed separately, which means the total cost can climb quickly over the course of a few months.

- Telehealth care, including options like Noom Med, is typically more cost-effective for people paying out of pocket. Instead of paying per visit, telehealth programs often charge a flat monthly fee. This usually covers the clinician evaluation, prescription management, and coordination of any required lab work. Having costs bundled this way makes monthly expenses easier to anticipate and avoids surprise bills tied to individual appointments.

If you’re looking for ways to keep prescription-related costs as low and predictable as possible, telehealth is often the most affordable path to getting and maintaining a Mounjaro® prescription.

Mounjaro® cost without insurance: Pharmacy comparison

If you are paying cash for Mounjaro®, the pharmacy you choose can have an impact on what you end up paying. Cash prices aren’t fixed, and they often vary by retailer, location, and dose. Some pharmacies start higher but may accept coupons, while others price closer to the list amount with fewer discount options.

For people shopping around, comparing pharmacy prices is usually the fastest way to find the lowest out-of-pocket cost. Below is a table based on GoodRx prices to help get you started:

| Retailer/pharmacy | Est. cash price | Insider tip |

|---|---|---|

| Costco | $995 | Prices tend to be consistent across locations. You typically do not need a membership to use the pharmacy, but it helps to call ahead to confirm availability. |

| Walmart | $995 | Often matches or comes close to other big-box pharmacies. Ask about in-store discount programs and which coupons they accept for cash pay. |

| CVS | $995 | Cash prices are usually on the higher side, but coupons can lower the final price. Always ask the pharmacist to apply available discounts. |

| Walgreens | $995 | Similar pricing to CVS and Walmart. Some locations are more flexible with coupon processing than others. |

| Raley’s | $1,057 | Regional grocery pharmacies may price slightly lower. Availability can vary, so checking stock first can save time. |

Disclaimer: Prices are estimates based on GoodRx cash-price data from January 2026. Actual prices may vary by available coupons, dose, location, and availability.

How to get Mounjaro® for $25

If you see people talking about getting Mounjaro® for $25 a month, they are usually talking about the manufacturer savings card from Eli Lilly. This card can lower what you pay, but it only works in certain situations. Here is how it actually works, step by step, without the fine print confusion.

What the Mounjaro® savings card actually does

If you have commercial insurance that covers Mounjaro®, the savings card can lower your cost to as little as $25 total for up to a 3-month prescription. A “month” is defined as 28 days and up to 4 single-dose pens. A 3-month supply equals up to 12 pens.

Insurance coverage matters

The $25 price only applies when your insurance covers Mounjaro®. If your insurance doesn’t cover Mounjaro®, the card can still help, but the price will not drop to $25. In that case, the savings card may reduce the monthly cost to as low as $499 for a 1-month supply, depending on pharmacy pricing and program limits.

Who is eligible for the savings card

You may qualify if:

- You have commercial or employer-sponsored drug insurance

- Your prescription is for Mounjaro® single-dose pens

- You are prescribed it for diabetes management

- You live in the U.S. or Puerto Rico and are 18 or older

You are not eligible if:

- You are enrolled in Medicare, Medicaid, TRICARE, VA, or other government programs

- Your insurance uses an alternate funding program tied to manufacturer coupons

How to use the Mounjaro® savings card

- Step 1: Visit the official Mounjaro® savings page on Eli Lilly’s website and check eligibility.

- Step 2: Talk with your healthcare provider about whether a 1-month or 3-month prescription makes sense for you.

- Step 3: Check your insurance plan to confirm if 3-month fills are allowed and whether any restrictions apply.

- Step 4: Contact your pharmacy to make sure they can fill the prescription amount your provider writes.

- Step 5: Use your savings card at checkout by showing the pharmacist the BIN, PCN, and Group codes listed on the card.

Savings card rules can change, and you need to meet the eligibility requirements each time you use it. As of now, the program is set to run through December 31, 2026, but Eli Lilly can update the terms at any time.

Proven ways to lower your monthly Mounjaro® cost

What you pay for Mounjaro® often depends on a few details that are easy to overlook. Understanding how coverage, savings programs, and payment options work can help keep monthly costs more manageable. Here are some tips to keep in mind:

- Use the Mounjaro® savings card if you have commercial insurance. Even if your insurance doesn’t cover it, the same card may still lower the price to around $499 per month, depending on program limits.

- Pay with HSA or FSA funds when allowed. Prescription medications like Mounjaro® are generally eligible expenses for HSAs and health FSAs when prescribed by a healthcare provider to treat a medical condition. Eligibility can vary by plan, so it’s a good idea to confirm with your HSA or FSA administrator. Paying this way doesn’t change the pharmacy price, but it can lower your real cost because the money is pre-tax.

- Look into nonprofit copay and grant programs. Some nonprofit organizations, such as the PAN Foundation or HealthWell Foundation, offer financial assistance for people who qualify. These programs may help cover part of your copay or other medication-related costs, especially for diabetes treatment.

- Compare pharmacies before you fill. Cash prices for Mounjaro® can vary by hundreds of dollars depending on the pharmacy. Checking prices at big-box stores, grocery pharmacies, and online pharmacies before filling your prescription can help you avoid overpaying.

- Review how your insurance handles savings cards. Some insurance plans count manufacturer discounts toward your deductible, while others do not. A quick call to ask about copay accumulator rules can help you understand how savings affect your overall costs during the year.

- Recheck coverage during open enrollment. Insurance coverage for Mounjaro® can change from year to year. Reviewing your plan during open enrollment may reveal different copays, prior authorization rules, or better coverage options.

Lowering the cost of Mounjaro® usually comes from stacking a few of these strategies together. Once you understand which options apply to you, the monthly price often becomes more predictable and easier to manage.

Weight loss medications: Alternatives to Mounjaro®

Even with insurance or savings programs, Mounjaro® can still land well above what many people feel comfortable paying each month. That doesn’t mean you are out of options.

If paying for Mounjaro® out of pocket won’t work for you, there are other prescription options worth considering. The closest option is Zepbound®, which contains the same active ingredient, tirzepatide, as Zepbound® at the same doses and is approved for weight loss. If you get the vial and syringe options through Lilly Direct, you will pay hundreds less for the medication. See the chart below for the cost comparison and what you’ll pay by dose.

Some other GLP-1 medications also come with lower out-of-pocket costs. There are also non-GLP-1 weight-loss medications that may be more affordable for certain people. Comparing options with your clinician can help you balance cost, effectiveness, and coverage. Let’s take a look at the options.

| Medication | Uses and approvals | Est. monthly cost |

|---|---|---|

| Mounjaro® (tirzepatide) | Type 2 diabetes (off-label for weight loss) | Pens (retail): $1,112 |

| Zepbound® (tirzepatide) | Weight loss and obstructive sleep apnea (OSA) | Pens (retail): $1,087 LillyDirect vials: $299: 2.5 mg; $399: 5 mg; $449: 7.5 mg, 10 mg, 12.5 mg, and 15 mg |

| Wegovy® (semaglutide) | Weight loss, heart disease risk reduction, and MASH | Pen (retail): $1,349 NovoCare Pharmacy Pen: $199: 0.25 mg and 0.5 mg; $349:1 mg, 1.7 mg, and 2.4 mg Pill: $149: 1.5 mg; $149–$199: 4 mg; $299: 9 mg and 25 mg |

| Ozempic® (semaglutide) | Type 2 diabetes (off-label for weight loss) | Pen (retail): $1,028 NovoCare Pharmacy: $199: 0.25 mg and 0.5 mg (for the first two months); $349: 0.5 mg and 1 mg; $499: 2 mg |

| Saxenda® (Liraglutide) | Weight loss | $1,349 |

| Victoza® (Liraglutide) | Type 2 diabetes and heart disease | $544: 0.6 mg and 1.2 mg doses $815: 1.8 mg dose |

| Generic liraglutide | Weight loss, heart disease, and type 2 diabetes treatment | $470–$1,200 |

Learn more about how Mounjaro® compares to other GLP-1 medications:

When does insurance cover Mounjaro®?

When it comes to Mounjaro®, coverage and out-of-pocket costs can vary based on diagnosis and plan rules. Below are a few factors that tend to affect what you pay for Mounjaro® with insurance:

- Diagnosis is the biggest factor. Plans are far more likely to cover Mounjaro® when it’s prescribed for type 2 diabetes. Coverage for weight management without a diabetes diagnosis is uncommon and often excluded.

- Plan design matters. Even within the same insurance company, one employer plan may cover Mounjaro® while another does not. When it is covered, copays often fall between $25 and $150, depending on deductibles and tiers.

- Approval is rarely automatic. Many plans require prior authorization, which means your clinician must submit documentation showing that Mounjaro® fits the plan’s criteria. This can take time and may involve follow-up requests.

Because these details vary so much, checking coverage directly or having your provider’s office verify benefits is usually the fastest way to understand what you’ll actually pay.

Does Medicare or Medicaid cover Mounjaro®?

Coverage under government programs follows a different rulebook and depends heavily on how the prescription is written.

- Medicare focuses on diabetes treatment. Medicare Part D and Medicare Advantage plans may cover Mounjaro® when it’s prescribed for type 2 diabetes. When approved, monthly copays are often relatively low ($10–$50/month). Medicare generally does not cover Mounjaro® when it’s prescribed solely for weight management.

- Medicaid coverage varies by state. Many states cover Mounjaro® for diabetes, but eligibility rules differ. Coverage for weight management remains limited, and policies can change as states reassess budgets and formularies. When covered, out-of-pocket costs are usually minimal.

- VA and TRICARE operate separately. Access through the VA may be available in specific clinical programs. TRICARE may cover Mounjaro® for diabetes with prior authorization and step-therapy requirements, often with predictable copays when approved.

Because these programs update coverage differently and on different timelines, the most reliable way to get clarity is to confirm benefits directly or ask a clinician’s office to check on your behalf.

For a deeper look at approval paths, plan differences, and real-world cost examples, see our full guide on Mounjaro® costs with and without insurance coverage.

Frequently asked questions about the cost of Mounjaro®

Even after seeing the numbers, it’s normal to have a few questions about Mounjaro® costs without insurance. The answers below cover the most common ones people ask.

What is the cheapest way to get Mounjaro® without insurance?

The lowest-cost path without insurance usually combines telehealth for the prescription with pharmacy discounts or manufacturer pricing programs. Telehealth options like Noom Med keep doctor costs predictable. If you are comfortable with using the single-dose vial form of tirzepatide, Eli Lilly’s direct-to-consumer vial pricing through LillyDirect for Zepbound® can be much cheaper.

Does the $25 coupon work if I have no insurance?

No. The $25 price only applies if you have commercial insurance that covers Mounjaro®. If you don’t have insurance coverage, the savings card can’t be used. If you have insurance drug coverage, but Mounjaro® isn’t included, then you can use the savings card. In those cases, the price typically lands closer to $499 per month. Again, this would only apply for diabetes management.

How much is Mounjaro® out of pocket?

Without insurance, most people see prices between about $995 and $1,200 per month, depending on the pharmacy and whether discounts are applied. The official list price is around $1,112, but many people pay something different once coupons or pharmacy pricing are factored in.

Does Noom Med include the cost of Mounjaro®?

No. The cost of Noom Med doesn’t include branded medications. If you qualify, Noom Med offers a monthly program that includes provider access for ongoing medical guidance and prescriptions, which can help reduce overall care costs. You are free to choose the pharmacy to fill your prescription. Through Noom Med, you’ll also get access to a Care Team to manage any side effects, our full behavior change program, including exclusive lessons, on-demand exercises to prevent muscle loss, hundreds of delicious recipes, and more.

Does the monthly cost of Mounjaro® include doctor visits?

No. The pharmacy price covers only the medication. Doctor visits, follow-ups, and lab work are separate unless they are bundled into a telehealth program. This is why care setup matters just as much as the price of the medication itself.

Can I get Mounjaro® for free?

Getting Mounjaro® completely free is rare. Some people may qualify for nonprofit assistance or very low copays through insurance, but there is no guaranteed free option. Most cost reductions come from insurance coverage, savings cards, or choosing lower-cost care and pharmacy options.

Can I get Mounjaro® through Eli Lilly’s patient assistance program?

Currently, Eli Lilly’s patient assistance program (Lilly Cares) doesn’t specifically cover Mounjaro®. Contact Lilly Support Services at 1-800-LillyRx to ask about other affordability options that might become available or explore whether you qualify for any state or nonprofit assistance programs.

The bottom line: There are limited ways to save on Mounjaro® without insurance

Mounjaro® can be highly effective, but without insurance, it remains one of the more expensive GLP-1 options—especially when prescribed for weight loss rather than diabetes. While savings cards, pharmacy discounts, and telehealth care can help make costs more predictable, most people paying cash should expect monthly prices near or above $1,000.

If your goal is weight loss and you’re paying out of pocket, Zepbound® is often the more cost-efficient path. It contains the same active ingredient (tirzepatide) in the same doses and offers lower cash-pay options through LillyDirect vial pricing. Looking ahead, proposed Medicare and Medicaid price changes announced in late 2025 may lower costs for some people in 2026—but those savings will still depend on diagnosis and coverage rules.

If you want to know all of the options open to you, see if you qualify for Noom Med. You’ll be paired with a clinician who can find the right medication for you and prescribe it, if needed. Plus, with Noom Med, care doesn’t stop at writing a prescription. You’ll have a Care Team to help you manage any side effects, plus lessons, guidance, and exclusive tools to help you build the best diet and exercise plan for you.

Note: Mounjaro®, Ozempic®, and Victoza® are not FDA-approved to treat obesity or for weight loss.

Editorial standards

At Noom, we’re committed to providing health information that’s grounded in reliable science and expert review. Our content is created with the support of qualified professionals and based on well-established research from trusted medical and scientific organizations. Learn more about the experts behind our content on our Health Expert Team page.